This content was created by the Data Sharing Coalition, one of the founding partners of the CoE-DSC.

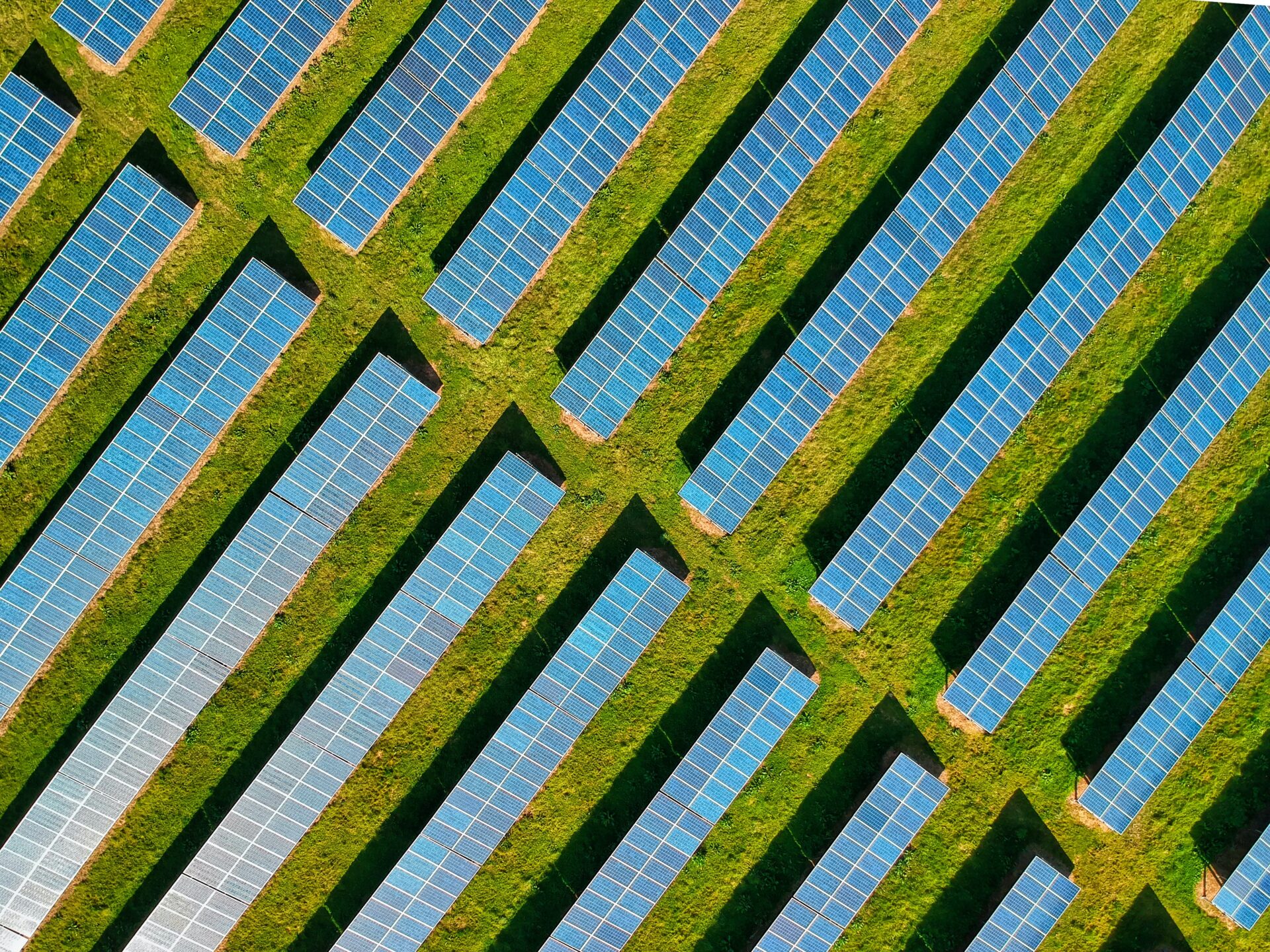

Today, the Data Sharing Coalition presents a report on the most important findings of the Green Loans use case. In this case, smart meter data from people’s homes is shared with financial service providers to develop loan propositions for investments to improve the sustainability of houses. This report provides insights on the context and value of this use case and the use case design. It concludes that this use case provides a foundation for other use cases within the mortgage domain and the energy domain.

Presence of existing ecosystems and need for consumer authorisation requires seamless interaction between ecosystems

Through multiple workshops, Hypotheken Data Netwerk, Netbeheer Nederland and the Data Sharing Coalition created a generic use case design (including a data sharing interaction model and an overview of business, legal, operational, functional and technical requirements for sharing data) that is scalable to and lays a foundation for other use cases.

The data sharing context of this use case is characterised by the presence of two existing ecosystems that want to share data with each other. Both ecosystems have their own standards on data exchange. Agreements between the two domains are needed to ensure seamless interaction between parties from both domains. Most important agreements are on Identification Authentication and Authorisation as parties from both domains need to be confident that they are dealing with the same consumer. In this use case the consumer needs to initiate the data sharing transaction in the financial services domain and needs to authorise the same data sharing in the energy domain.

Expanding the use case scope may enable other use cases

To create more value with this use case and to enable other use cases in the future the current use case scope can be expanded through sharing more granular energy data, adding more data sources in the loan application process and connecting new ecosystems to either the financial or energy data sharing ecosystem. In the future, this use case can be improved by providing more granular data (instead of monthly averages) over a longer period (than the current 13 months) to financial service providers. Also, other data about a house’s energy characteristics such as its energy label can be shared with the financial service provider. Lastly the use case could be scaled to use more external data in the loan application process or use smart meter data for other purposes.

In the coming months Hypotheken Data Netwerk and Netbeheer Nederland will operationalise this use case through a pilot to provide Green loans to consumers. With this they want to prove the value of the use case in a real-life setting.

More details on the findings can be found in the report.

If you would like to get involved in the use case (e.g. as an Industry Association), please send us an email: info@coe-dsc.nl